Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

Detail Summery about Final Accounts, Trading Account, Profit and Loss Account, Manufacturing Account,Balance sheet.

Typology: Lecture notes

1 / 21

This page cannot be seen from the preview

Don't miss anything!

1

This account gives the cost of the goods manufactured by a manufacturer during a particular period. Dr Manufacturing A/c Cr

To work in process (opening) By work in process (closing) To Raw Material consumed: Opening stock Add: purchase of raw material Less: closing stock of raw material By sale of scrap To factory overheads By cost of production transferred to trading A/c^4

5

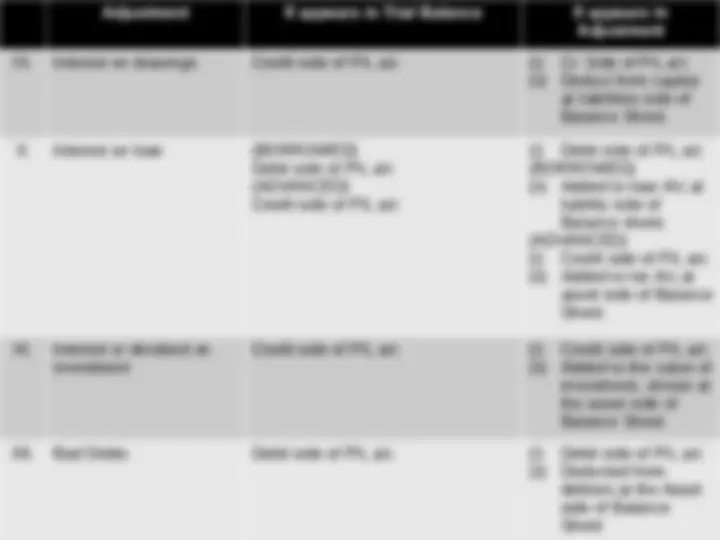

7 While preparing final accounts, at the end of every accounting period, we come across certain problems. The accountant may come to know of certain adjustments to be made in the books of accounts to give a true picture of the state of affairs of the business after closing the books of accounts. These adjustments generally relate to the following: Adjustment If appears in Trial Balance If appears in Adjustment I. Closing stock Cr. Side of trading a/c (i) Cr. Side of trading A/c (ii) Asset side of Balance sheet II. Depreciation Dr. side of P/L a/c (i) Dr. side of P/L a/c (ii) Reduce the value of concerned asset in balance sheet III. Appreciation Cr. Side of P/L a/c (i) Cr. Side of P/L a/c (ii) Increase the value of concerned asset in balance sheet IV. Outstanding Expenses Liability side only in Balance Sheet (i) Added to concerned expense at the debit side of Trading or P/L a/c (ii) Liability side of Balance Sheet

8 Adjustment If appears in Trial Balance If appears in Adjustment V. Prepaid expenses Asset side of Balance Sheet (i) Deduce from concerned expenses at the debit side of Trading or P/L a/c (ii) Asset side of Balance Sheet VI. Outstanding or Accrued income Asset side of Balance sheet (i) Added to the concerned income at the credit side of P/L a/c (ii) Asset side of Balance Sheet VII. Unearned Income Shown at the liabilities side of Balance Sheet (i) Deduct from the concerned income at the credit side of P/L a/c (ii) Shown at liabilities side of Balance Sheet. VIII. Interest on capital Debit side of the P/L a/c (i) Dr. side of P/L a/c (ii) Increase amount of capital at the liabilities side of

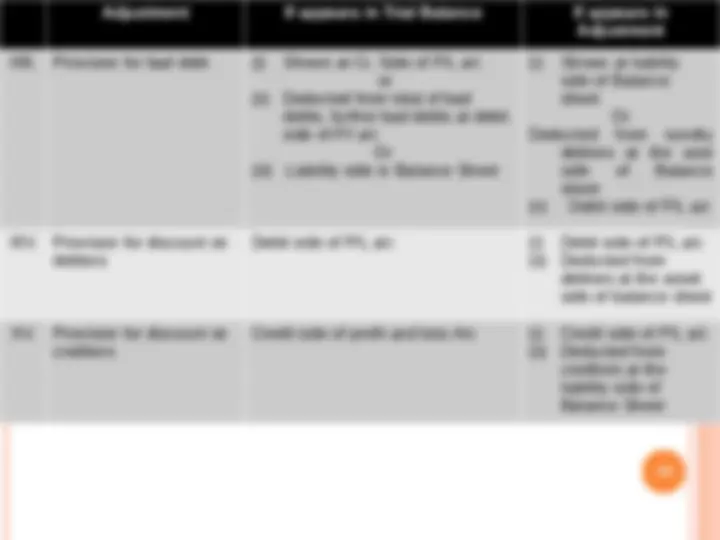

10 Adjustment If appears in Trial Balance If appears in Adjustment XIII. Provision for bad debt (i) Shown at Cr. Side of P/L a/c or (ii) Deducted from total of bad debts, further bad debts at debit side of P/l a/c Or (iii) Liability side in Balance Sheet (i) Shown at liability side of Balance sheet Or Deducted from sundry debtors at the asst side of Balance sheet (ii) Debit side of P/L a/c XIV. Provision for discount on debtors Debit side of P/L a/c (i) Debit side of P/L a/c (ii) Deducted from debtors at the asset side of balance sheet XV. Provision for discount on creditors Credit side of profit and loss A/c (i) Credit side of P/L a/c (ii) Deducted from creditors at the liability side of Balance Sheet

ST

____________________________________________________________________________ 353160 353160

THE FOLLOWING IS THE TRIAL BALANCE OF SRI OM AS ON 31ST^ MARCH, 1999. YOU ARE REQUESTED TO PREPARE THE TRADING AND PROFIT AND LOSS A/C FOR THE YEAR ENDED 31ST^ MARCH1999 AND BALANCE SHEET AS ON THAT DATE Particulars^ AFTER MAKING THE NECESSARY ADJUSTMENTS Debit ( Rs.) : Credit (Rs.) Sundry debtors Sundry creditors Outstanding expenses Wages Carriage outwards Carriage Inwards General Expenses Cash Discounts Bad debts Motor car Printing and stationery Furniture and fittings Advertisement Insurance Salesmen’s commission Postage and telephone Salaries Rates and taxes Drawings Capital Account Purchases Sales Stock on 1.4. Cash at Bank Cash in hand 500000 55000 100000 110000 50000 70000 20000 10000 240000 15000 110000 85000 45000 87500 57500 160000 25000 20000 1550000 2, 60000 10500 36,30, 200000 14,43, 19,87, 36,30, 13

14

16

17

Machinery A/c Dr. Cr. Date Particulars J.F. Amount Date Particulars J.F. Amount 1 st^ july 1993 To bank A/c 40000 Dec 31 1993 By depreciation (on 40000 for six months) 2000 Dec31 By bal c/d 38000 40000 40000 19

20