Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

An overview of the international monetary system, including the bretton woods system, the current exchange rate arrangements between the u.s. And the u.k., the european monetary system (ems), and the adoption of the euro and the european monetary union. It covers topics such as the objectives and benefits of a common european currency, the conduct of monetary policy for the euro-12 countries, and the advantages of fixed exchange rates. The document also discusses the law and corporate governance aspects, including the relationship between ownership and control patterns, the protection of shareholder rights, and the quality of law enforcement in different legal systems. Additionally, it covers exchange rate forecasting approaches, such as the efficient market, fundamental, and technical approaches, as well as the accuracy of paid exchange rate forecasters. The document also addresses transaction exposure, translation exposure, and hedging strategies for multinational corporations.

Typology: Cheat Sheet

1 / 123

This page cannot be seen from the preview

Don't miss anything!

Eun & Resnick 4e CHAPTER 1 Globalization and the Multinational Firm

Questions in the test bank follow the order of the chapter outline:

What’s Special about International Finance? Foreign Exchange and Political Risks Market Imperfections Expanded Opportunity Set Goals for International Financial Management Globalization of the World Economy: Major Trends Emergence of Globalized Financial Markets Emergence of the Euro as a Global Currency Trade Liberalization and Economic Integration Privatization Multinational Corporations Summary MINI CASE: Nike and Sweatshop Labor APPENDIX 1A: Gains from Trade: The Theory of Comparative Advantage

What’s Special about “International” Finance?

What major dimension sets apart international finance from domestic finance? a) foreign exchange and political risks b) Market imperfections c) Expanded opportunity set d) all of the above Answer: d

An example of a political risk is a) Expropriation of assets b) Adverse change in tax rules c) The opposition party being elected d) a) and b) are both correct Answer: d - p. 5

Production of goods and services has become globalized to a large extent as a result of a) Skilled labor being highly mobile b) Natural resources being depleted in one country after another c) Multinational corporations’ efforts to source inputs and locate production anywhere where costs are lower and profits higher d) Common tastes worldwide for the same goods and services Answer: c - p. 4

Recently, financial markets have become highly integrated. This development

a) Allows investors to diversify their portfolios internationally b) Allows minority investors to buy and sell stocks c) Has increased the cost of capital for firms d) Answers a) and c) are both correct. Answer: a. see page 4

Japan has experienced large trade surpluses. Japanese investors have responded to this by a) Liquidating their positions in stocks to buy dollar denominated bonds b) Investing heavily in U.S. and other foreign financial markets c) Lobbying the U.S. government to depreciate its currency d) Lobbying the Japanese government to allow the yen to appreciate Answer: b - p. 4

Suppose your firm invests $100,000 in a project in Italy. At the time the exchange rate is $1.25 = €1.00. One year later the exchange rate is the same, but the Italian government has expropriated your firm’s assets paying only €80,000 in compensation. This is an example of a) Exchange rate risk b) Political risk c) Market imperfections d) None of the above, since $100,000 = €80,000×$1.25/€1. Answer: b) political risk —the government is only giving you back your initial investment, if this was a good investment it should have been worth more than $100,000 a year later. For example if your cost of capital was 8% it should have been worth $108,000.

Suppose that Great Britain is a major export market for your firm, a U.S. based MNC. If the British pound depreciates against the U.S. dollar, a) Your firm will be able to charge more in dollar terms while keeping pound prices stable. b) Your firm may be priced out of the U.K. market, to the extent that your dollar costs stay constant and your pound prices will rise. c) To protect U.K. market share, your firm may have to cut the dollar price of your goods to keep the pound price the same. d) b) and c) are both correct. Answer: b) and c) are both correct. See page 5.

Most governments at least try to make it difficult for people to cross their borders illegally. This barrier to the free movement of labor is an example of a) Information asymmetry b) Excessive transactions costs c) Racial discrimination d) A market imperfection Answer: d) see page 6.

When individual investors become aware of overseas investment opportunities and are

a) Show that managers might be tempted to pursue their own private interests at the expense of shareholders. b) Show that Italian shareholders are better at monitoring managerial behavior than U.S. shareholders. c) Show that white-collar criminals hardly ever get punished. d) Show that socialism is a better way to go than capitalism. Answer a) see page 9.

While the corporate governance problem is not confined to the United States, a) It can be a much more serious problem in many other parts of the world, where legal protection of shareholders is weak or nonexistent. b) It has reached its high point in the United States. c) The U.S. legal system, with lawsuits used only as a last resort, ensured that any conflicts of interest will soon be a thing of the past. d) None of the above Answer: a) see page 9.

The owners of a business are the a) Taxpayers b) Workers c) Suppliers d) Shareholders Answer: d)

The massive privatization that is currently taking place in formerly socialist countries, will likely a) eventually enhance the standard of living to these countries’ citizens b) depend on private investment c) increase the opportunity set facing these countries’ citizens d) all of the above Answer: d) See page 10.

A firm with concentrated ownership a) May give rise to conflicts of interest between dominant shareholders and small outside shareholders. b) May enjoy more accounting transparency than firms with diffuse ownership structures. c) Is a partnership, never a corporation. d) Tends to exist overseas but not in the U.S. Answer: d) See page 9.

The ultimate guardians of shareholder interest in a corporation, are the a) Rank and file workers

b) Senior management c) Boards of directors d) All of the above Answer: c) See page 9.

In countries like France and Germany, a) Managers have often made business decisions with regard maximizing market share to the exclusion of other goals. b) Managers have often viewed shareholders as one of the ―stakeholders‖ of the firm, others being employees, customers, suppliers, banks and so forth. c) Managers have often regarded the prosperity and growth of their combines, or families of related firms, as their critical goal. d) Managers have traditionally embraced the maximization of shareholder wealth as the only worthy goal. Answer: b) see page 9.

When corporate governance breaks down a) Shareholders are unlikely to receive fair returns on their investments b) Managers may be tempted to enrich themselves at shareholder expense c) The board of directors is not doing its job d) All of the above Answer: d)

Globalization of the World Economy

Privatization refers to process of: a) Having government operate businesses for the betterment of the public sector b) Government allowing the operation of privately owned business c) Prohibiting government operated enterprises d) A country divesting itself of the ownership and operation of a business venture by turning it over to the free market system Answer: d - p. 14

Deregulation of world financial markets a) Provided a natural environment for financial innovations, like currency futures and options. b) Has promoted competition among market participants. c) Has encouraged developing countries such as Chile, Mexico, and Korea to liberalize by allowing foreigners to directly invest in their financial markets. d) All of the above Answer: d see page 10.

The emergence of global financial markets is due in no small part to a) Advances in computer and telecommunications technology

b) Covers agriculture and physical goods, but not services or intellectual property rights. c) Recently expelled China for human rights violations. d) Ruled that NAFTA is to be the model for world trade integration. Answer: b) page 14.

a) Has spurred a tremendous increase in cross-border investment. b) Has allowed many governments to have the funds to nationalize important industries. c) Has guaranteed that new ownership will be limited to the local citizens. d) Has generally decreased the efficiency of the enterprise. Answer: b) page 15-16.

Multinational Corporations

A multinational firm can be defined as a) A firm that invests short-term cash inflows in more than one currency b) A firm that has sales affiliates in several countries c) A firm that is incorporated in more than one country d) A firm that incorporated in one country that has production and sales operations in several other countries. Answer: d - p. 15

A MNC may gain from its global presence by a) Spreading R&D expenditures and advertising costs over their global sales b) Pooling global purchasing power over suppliers c) Utilizing their technological and managerial know-how globally with minimum additional costs d) All of the above are potential gains. Answer: d) page 17.

MNCs can use their global presence to a) Take advantage of underpriced labor services available in certain developing

countries b) Gain access to special R&D capabilities residing in advanced foreign counties. c) Boost profit margins and create shareholder value. d) All of the above. Answer: d) page 17.

Foreign-owned manufacturing companies a) Generally are more productive and pay their workers more than do comparable locally-owned businesses, in the world’s most highly developed countries. b) Generally are more productive and pay their workers less than do comparable locally-owned businesses, in the world’s most least developed countries. c) Tend to specialize in articles of manufacture that are illegal in their home countries. d) Gain from their global presence by paying their workers in shoes. Answer: d – see International Finance in Practice p. 17

A purely domestic firm sources its products, sells its products, and raises its funds domestically a) Can face stiff competition from a multinational corporation that can source its products in one country, sell them in several countries, and raise its funds in a third country. b) Can be more competitive than a MNC on its home turf due to superior knowledge of the local market c) Can still face exchange rate risk, just like a MNC d) All of the above are true. Answer: d

MNC stands for a) Multinational Corporation b) Mostly National Corporation c) Messy National Corporation d) Military National Cooperation Answer: a)

Which is growing at a faster rate, foreign direct investment by MNCs or international trade? a) FDI by MNCs b) International trade c) Since they are linked, they grow at the same rate d) None of the above Answer: a) page 16.

A true MNC, with operations in dozens of different countries a) Must effectively manage foreign exchange risk b) Can ignore foreign exchange risk since it is diversified

c) Exists when one party can produce a good or service at a lower opportunity cost than another party. d) All of the above Answer: d)

1010101010

66666

Country CountryCountryCountryCountry AAAAA

CountryCountryCountryCountryCountry BBBBB

55555

88888

foodfoodfoodfoodfood

textilestextilestextilestextilestextiles

If one country is twice the size of another country and is better at making almost everything than the benighted citizens of the smaller county, a) The bigger county enjoys an absolute advantage b) The bigger county enjoys an relative advantage c) The bigger county enjoys an comparative advantage d) There is not enough information to make a determination Answer: a) see page 22.

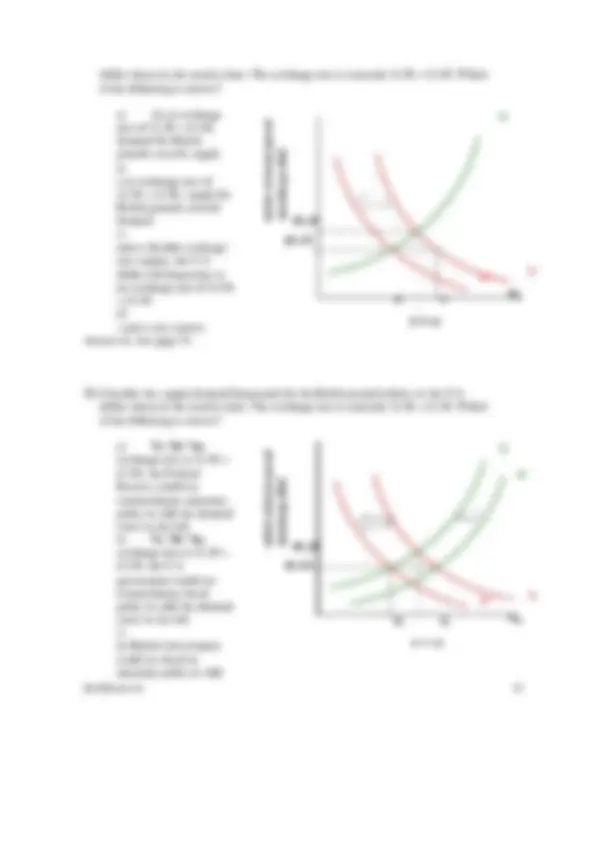

Country A can produce 10 yards of textiles and 6 pounds of food per unit of input. Country B can produce 8 yards of textiles and 5 pounds of food per unit of input. a) Country A is relatively more efficient than Country B in the production of textiles b) Country B is relatively more efficient than Country A in the production of food c) Country A has an absolute advantage over Country B in the production of food and textiles d) All of the above Answer: d - pp.24 - 25 Rationale: Country A has an opportunity cost of 1 yard of textiles per .6 (= 6/10) pounds of food; Country B has an opportunity cost of 1 yard of textiles for .63 (= 5/8) pounds of food. Country A has an opportunity cost of 1 pound of food per 1.67 (= 10/6) yards of textiles; Country B has an opportunity cost of 1 pound of food for 1.60 (= 8/5) yards of textiles. Thus, Country A has an absolute advantage and a relative efficiency over Country B in the production of textiles. Country B has a relative efficiency over Country A in the production of food. Country B does not have an absolute advantage over Country A in the production of

food or textiles.

(^1010101010)

66666

CountryCountryCountryCountryCountry AAAAA

CountryCountryCountryCountryCountry BBBBB

55555

88888

foodfoodfoodfoodfood

textilestextilestextilestextilestextiles

Slope ofSlope ofSlope ofSlope ofSlope of linelinelinelineline =====^

55555 33333

Slope ofSlope ofSlope ofSlope ofSlope of linelinelinelineline =====^

88888 55555

12001200120012001200

Country CountryCountryCountryCountry AAAAA

CountryCountryCountryCountryCountry BBBBB

600600600600600

foodfoodfoodfoodfood

textilestextilestextilestextilestextiles

Slope ofSlope ofSlope ofSlope ofSlope of linelinelinelineline =====^

22222 11111

Slope ofSlope ofSlope ofSlope ofSlope of linelinelinelineline =====^

11111 22222

400400400400400

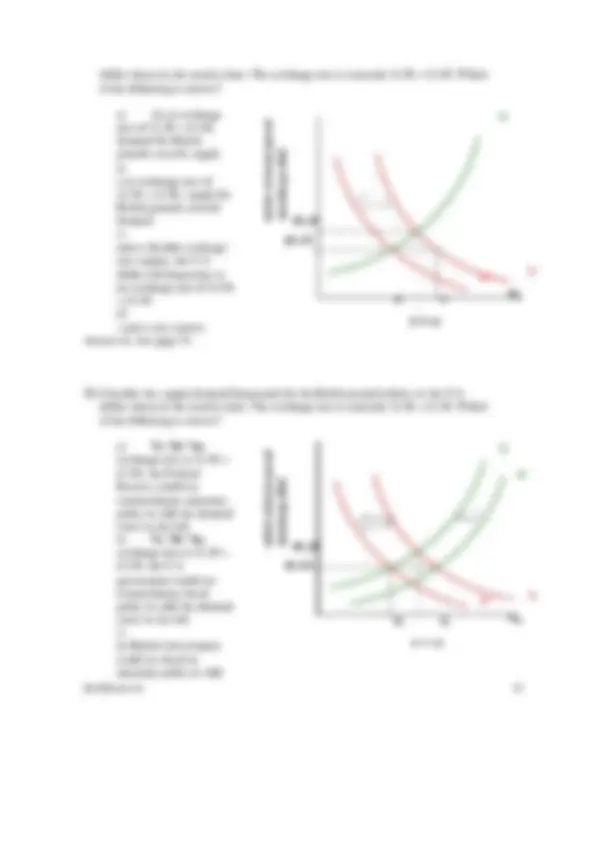

(^4004004004004006666600000000001212121212000000) 0000 Under the theory of comparative advantage a) The citizens of country A should make food and trade with the citizens of country B for textiles b) The citizens of country A should make textiles and trade with the citizens of country B for food c) There are no gains from trade in this example d) A is twice as good as B at making food and B is twice as good as A at making textiles Answer: b) Rationale: consider the shape of the combined production possibilities curve with and without trade: The citizens of country A should make textiles and trade with the citizens of country B for food; the citizens will be able to go from the point shown on the combined no trade line to

somewhere better.

12001200120012001200 AAAAA

BBBBB

600600600600600

foodfoodfoodfoodfood

textilestextilestextilestextilestextiles

400400400400400

(^4004004004004006666600000000001212121212000000) 0000

18001800180018001800

(^18181818180000000000)

CCCCCooooommmmmbi bibibibinnnned,n ed,ed,ed, noed,nononono t ttttraderaderaderaderade

CCCCCooooommmmbim bibibibinnnnned,ed,ed,ed,ed, witwitwitwitwith hhhh tttttra rarararadedededede

b) (i), (iii), (v), (ii), and (iv) c) (vi), (i), (iii), (ii), and (v) d) (v), (ii), (i), (iii), and (iv) Answer: b

Bimetallism: Before 1875

Gresham’s Law states that ( ) a) Bad money drives good money out of circulation. b) Good money drives bad money out of circulation c) If a country bases its currency on both gold and silver, at an official exchange rate, it will be the more valuable of the two metals that circulate. d) None of the above. Answer: a

In the 1850s the French franc was valued by both gold and silver, under the official French ratio which equated a gold franc to a silver franc 15½ times as heavy. At the same time, the gold from newly discovered mines in California poured into the market, depressing the value of gold. As a result, a) The franc effectively became a silver currency. b) The franc effectively became a gold currency. c) Silver became overvalued under the French official ratio d) Answers a) and c) are correct Answer: b

Suppose that the pound is pegged to gold at £20 per ounce and the dollar is pegged to gold at $35 per ounce. This implies an exchange rate of $1.75 per pound. If the current market exchange rate is $1.80 per pound, how would you take advantage of this situation? Hint: assume that you have $350 available for investment. a) Start with $350. Buy 10 ounces of gold with dollars at $35 per ounce. Convert the gold to £200 at £20 per ounce. Exchange the £200 for dollars at the current rate of $1.80 per pound to get $360. b) Start with $350. Exchange the dollars for pounds at the current rate of $1.80 per pound. Buy gold with pounds at £20 per ounce. Convert the gold to dollars at $ per ounce. c) a) and b) both work d) none of the above Answer: a

Prior to the 1870s, both gold and silver were used as international means of payment and the exchange rates among currencies were determined by either their gold or silver contents. Suppose that the dollar was pegged to gold at $30 per ounce, the French franc is pegged to gold at 90 francs per ounce and to silver at 6 francs per ounce of silver, and the German mark pegged to silver at 1 mark per ounce of silver. What would the exchange rate between the U.S. dollar and German mark be under this system?

a) 1 German mark = $ b) 1 German mark = $0. c) 1 German mark = $ d) 1 German mark = $ Answer: a page 26. Rationale: Start with $30, buy one ounce of gold. Sell that ounce of gold for FF 90. Sell the FF90 for 15 ounces of silver. Buy 15 German marks. Thus, $30 = DM15.

Classical Gold Standard: 1875-

An “international” gold standard can be said to exist when a) gold alone is assured of unrestricted coinage b) there is two-way convertibility between gold and national currencies at stable ratios c) gold may be freely exported or imported d) all of the above Answer: d - p. 28

Suppose that the British pound is pegged to gold at £6 per ounce, whereas one ounce of gold is worth €12. Under the gold standard, any misalignment of the exchange rate will be automatically corrected by cross border flows of gold. Calculate the possible savings for buying €1,000, if the British pound becomes undervalued and trades for €1.80. (Assume zero shipping costs). (Hint: Gold is first purchased using the devalued British pound from the Bank of England, then shipped to France and sold for €1,000 to the Bank of France). a) £55. b) £65. c) £75. d) £85. Answer: a - p. 28

Rationale: Since an ounce of gold should be worth the same north or south of the English Channel, it should be €12 = £6. So our exchange rate implied by gold prices is €2 = £1, therefore buying €1,000 should cost £500: €1,000×£1/€2 = £500.

If the pound is undervalued at €1.80, we find that €1,000 costs £555.56: €1,000×£1/€1.80 = £555.

Savings in buying €1,000 by using gold and not posted exchange rates: £555.56 - £500.00 = £55.

Answer: b page 28

Bretton Woods System: 1945-

Under the Bretton Woods system a) there was an explicit set of rules about the conduct of international monetary policies b) each country was responsible for maintaining its exchange rate within 1 percent of the adopted par value by buying or selling foreign exchanges as necessary c) the U.S. dollar was the only currency that was fully convertible to gold d) all of the above Answer: d.

Under the Bretton Woods system: a) Each country established a par value for its currency in relation to the dollar. b) The U.S. dollar was pegged to gold at $35 per ounce. c) each country was responsible for maintaining its exchange rate within 1 percent of the adopted par value by buying or selling foreign exchanges as necessary d) all of the above Answer: d.

Since the SDR is a “portfolio” of currencies a) Its value tends to be more stable than the value of any of the individual currencies included in the SDR b) Its value tends to be less stable than the value of any of the individual currencies included in the SDR c) Its value tends to be as stable as the average of the individual currencies included in the SDR d) None of the above Answer: a) Rationale: while this is in the book on page 31, many students tend to miss this one. Any

portfolio is less volatile than the average volatility of the individual securities, as long as at least two securities are not perfectly positively correlated. This is certainly the case with currencies.

b) a “portfolio” of currencies, and its value tends to be more stable than the currencies that it is comprised of c) used in addition to gold and foreign exchanges, to make international payments d) all of the above Answer: d - p. 32

The Flexible Exchange Rate System

Gold was officially abandoned as an international reserve asset: a) In the January 1976 Jamaica Agreement b) In the 1971 Smithsonian Agreement c) In the 1944 Bretton Woods Agreement d) None of the above Answer: a

Following the demise of the Bretton Woods system, the IMF a) Created a new role for itself, providing loans to countries facing balance-of- payments and exchange rate difficulties. b) Ceased to exists, since the era of fixed exchange rates had ended. c) Became the sole agent responsible for maintaining fixed exchange rates. d) Became the central bank of the United Nations Answer a page 32.

Under a purely flexible exchange rate system a) Supply and demand set the exchange rates b) Governments can set the exchange rate by buying or selling reserves c) Governments can set exchange rates with fiscal policy d) B) and c) are correct. Answer a Rationale: under a purely flexible system, the government doesn’t interfere.

Current Exchange Rate Arrangements

A currency board arrangement is: a) When the currency of another country circulates as the sole legal tender b) When the country belongs to a monetary or currency union in which the same legal tender is shared by the members of the union. c) A monetary regime based on an explicit legislative commitment to exchange domestic currency for a specified foreign currency at a fixed exchange rate, combined with restrictions on the issuing authority to ensure the fulfillment of its legal obligation. d) Where the country pegs its currency at a fixed rate to a major currency where the exchange rate fluctuates within a narrow margin of less than one percent. Answer: c page 34.

Ecuador does not have its own national currency, circulating the U.S. dollar instead.