Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

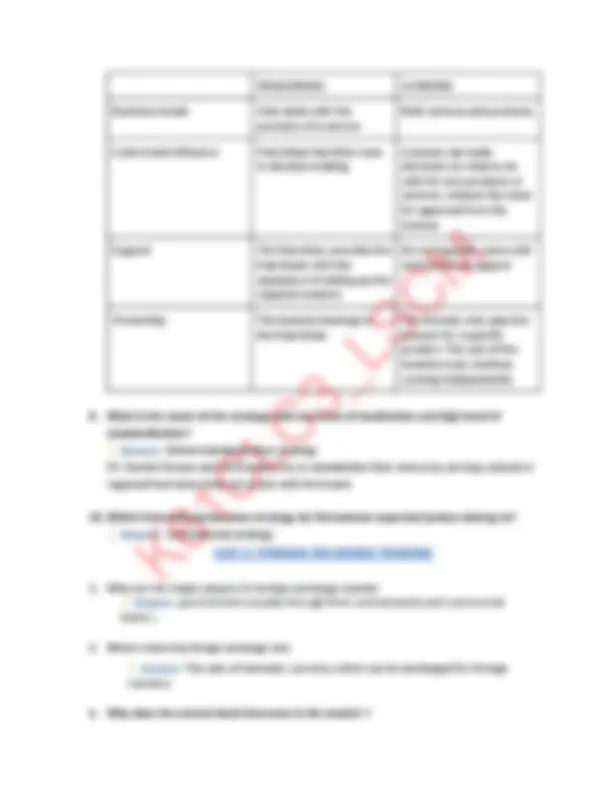

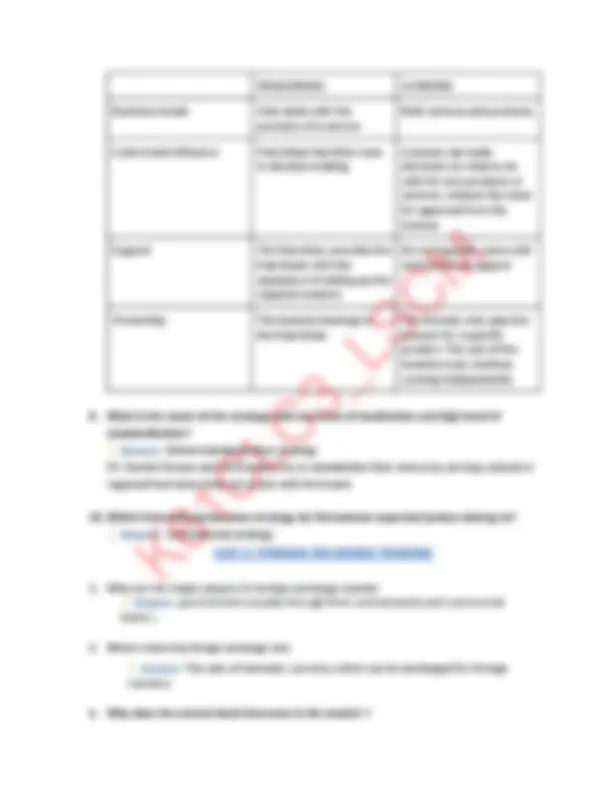

Various aspects of trade policies, including tariffs, quotas, protectionism, and free trade agreements. It also explores marketing concepts such as the 4p's, communication channels, distribution channels, and service channels. Definitions, examples, and answers to questions related to these topics.

Typology: Exams

1 / 15

This page cannot be seen from the preview

Don't miss anything!

Sep 22, 2023

● Protect their strategic industries; ● Make imports more expensive than home-produced substitutes → reduce balance of payments deficit; ● Protect against dumping; ● Retaliate against restrictions imposed by other countries; ● Protect their “infant industries”; ● Know the quantity that will be imported.

Phrases (cho sẵn): protectionism, mercantilism, imports, exports, free trade, infant industries, dumping, anti- dumping, investment

a. Import quotas always result in positive economic outcomes for a country. (False) b. Free trade agreements aim to reduce or eliminate tariffs and quotas between participating countries. (True) c. Tariffs are more effective at restricting trade than quotas. (False) d. Tariffs and quotas can have negative consequences for the overall economy. (True) e. Tariffs and quotas are both examples of non-tariff barriers to trade. (False)

………….(1)………., an economic theory that prevailed in the past, promoted …………(2)……….. through the use of tariffs and quotas. ………(3).......... were imposed on imported goods to discourage foreign competition and protect domestic industries, while ……….(4)........... limited the quantity of foreign goods that could enter a country. These protectionist measures were believed to be essential for a nation's economic growth and self-sufficiency, but in today's globalized world, many argue that ……….(5).......... and open markets provide more opportunities for prosperity and cooperation among nations. 💡 Answers: (1) Mercantilism (2) protectionism

(3) Tariffs (4) quotas (5) free trade

💡 Answers: ● They are aware of the export success of the East Asian “Tiger" economies and the collapse of the Soviet Union ● Afraid of being excluded from the trading system due to the development of trading blocks like the EU,... ● Maastricht Treaty and the North American Free Trade Agreement both signed in the 1990s.

💡 (^) Answers: Oil: The top three LDC exporters of oil in 2022 were Angola, Chad, and Yemen. Oil exports accounted for over 90% of total exports for each of these countries. Minerals: The top three LDC exporters of minerals in 2022 were Guinea, the Democratic Republic of the Congo, and Zambia. Minerals accounted for over 80% of total exports for each of these countries. Agriculture: The top three LDC exporters of agricultural products in 2022 were Bangladesh, Ethiopia, and Cambodia. Agricultural products accounted for over 60% of total exports for each of these countries.

UNIT 2

💡 Answers:

Unit 3: FOREIGN EXCHANGE TRADING

Unit 4

Cash in advance is a payment method where the buyer pays for the goods or services before they are shipped or delivered. This payment method is considered to be the most secure for the exporter because they receive payment before shipping the goods. The buyer can pay via wire transfer, credit card, or escrow service. The risk that the buyer may face with this payment method is that they may pay for goods that are never delivered3. This can happen if the exporter fails to deliver the goods after receiving payment. Therefore, it is important for buyers to ensure that they are dealing with a reputable exporter before making a cash-in-advance payment

An open account is commonly used in business to establish a credit relationship between a buyer and a seller. It allows the buyer to make purchases on credit, with payment usually due within a specified period, such as 30 days. Open accounts are often used when there is an ongoing business relationship between the two parties, and it provides convenience and flexibility for both the buyer and the seller. However, it is important to establish clear terms and conditions to ensure timely payment and avoid any potential issues.

The term confirmed letter of credit refers to an additional guarantee to an original letter of credit obtained by a borrower from a second bank. It guarantees that the second bank will pay the seller in a transaction if the first bank fails to do so. Borrowers may be required to get a confirmed letter of credit if the seller has doubts about the creditworthiness of the bank that issued the initial letter. Requiring a confirmed letter of credit decreases the risk of default for the seller.

6. What should the seller/beneficiary do if the terms of the letter of credit are not in accordance with those of the contract? 1. The first step is to carefully review the letter of credit to identify the specific discrepancies between its terms and the terms of the contract. 2. Communicate with the issuing bank. Provide them with contract details, explain the inconsistencies and request an amendment to the L/C that aligns with the contract terms. 3. Negotiate with the buyer if the issuing bank is uncooperative or if the discrepancies cannot be easily corrected through an amendment. In case the terms of the L/C deviate from the contract and the seller is not willing to accept those changes, they may refuse to proceed with the transaction and cancel the contract.

Reduced Risk of Non-Payment: The exporter enjoys a reduced risk of non-payment since the LC is a legally binding contract between the bank and the buyer, ensuring payment upon meeting the LC terms. Improved Cash Flow: LCs can enhance cash flow by ensuring prompt payment upon shipment once the necessary documentation is presented, allowing exporters to plan their finances more effectively. Increased Sales Opportunities: Exporters can attract new business by offering LCs as a payment method, as it instills confidence in buyers, especially in high-risk markets where non-payment is a concern. Disadvantages: Cost: LCs can be expensive due to various fees associated with their issuance and confirmation. The overall cost can vary based on transaction size and complexity. Complexity: Setting up and managing LCs can be complex and time-consuming. Exporters must thoroughly understand the terms and conditions to avoid potential payment issues.

💡 Answers: A Unique Selling Proposition (USP) is a factor that differentiates a product from its competitors, such as the lowest cost, the highest quality, or the first-ever product of its kind. In marketing, a USP is crucial as it provides a unique reason for the customers to purchase the product, highlighting the unique value it offers compared to competing products. 8/ What is "SWOT Analysis," and what does each letter represent? 💡 Answers: SWOT Analysis is a strategic planning tool used to identify and analyze the Strengths, Weaknesses, Opportunities, and Threats related to business competition or project planning. Strengths and Weaknesses are internal factors, while Opportunities and Threats are external factors. 9/ When do we need stimulational marketing 💡 Answers: Stimulational marketing is necessary where there's no demand, which often happens with new products and services. 10/ What is the objective of demarketing? 💡 (^) Answers: To reduce overfull demand, permanently or temporarily, for some roads and bridges during rush hours. 11/ What does the ‘qsp’ framework represent, and why is it important for businesses? 💡 (^) Answers: The ‘qsp’ framework represents the three critical factors or ‘customer value triad’ that businesses consider when making decisions about products or services: Quality, Service, and Price. It's important because it helps companies find the right balance between these factors to meet customer needs, stay competitive, and achieve long-term success. 12/ Provide an example illustrating the difference between needs, wants, and demands? 💡 Answers: Consider the scenario of a person requiring transportation. Their basic need is to get from one place to another, which can be fulfilled by walking or using public transportation. However, their want may be to have a comfortable and convenient mode of transport, such as a car, which goes beyond the basic need. If they have the financial means to purchase a car and actively seek one, their demand for a specific car model represents the willingness and ability to convert their want into a purchase. 13/ What is the difference between selling and marketing? 💡 Answers:

5. What types do the liability transfer when goods are on board the vessel? FOB CFR CIF 6. Differentiate between these 2 factors when choosing transport mode: perishability and pilferability Perishability: goods that spoil quickly and therefore have a short shelf life, such as milk, bread, fruit, and vegetables. Pilferability: an act of stealing items or things of little value 7. What types does the liability transfer when goods are handed over to the first carrier (origin destination)? CPT, CIP, fca 8. What type only applies for sea and inland waterway? CFR, CIF, FOB, FAS 9. According to EXW, when does the seller’s responsibility end? When the goods are delivered at the seller’s premise. 10. What are the types of sea freight rates? Liner rates (Scheduled services) & Charter rates (Usually negotiated) Liner rates (Scheduled services): They are used for regular, pre-scheduled shipping services that operate on established routes and schedules. & Charter rates (Usually negotiated): Instead of using pre-scheduled services, charter rates involve the hire of an entire vessel (or a significant portion of it) for a specific voyage or period.

Unit 7: MARINE CARGO INSURANCE