Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

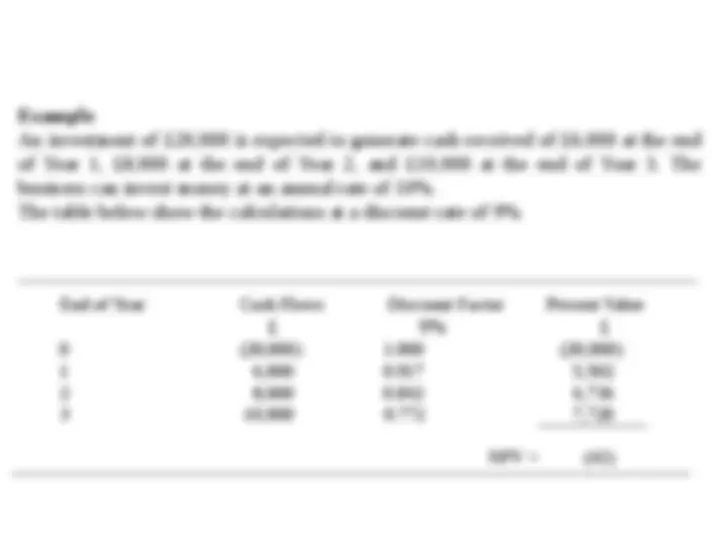

The difference between an investment’s market value and its cost The amount that an investor would pay today or the right to receive that future amount. Relies on the amount of future cash flows, the length of time that investor must wait and the rate of return required by the investor. Present Value of Cash Flow as the same as discounted cash flow.

Typology: Lecture notes

1 / 49

This page cannot be seen from the preview

Don't miss anything!

McGraw-Hill/Irwin Copyright^ © 2006 by The McGraw-Hill Companies, Inc. All

Capital Budgeting Decision Project Generation Project Evaluation Project Selection Project Execution Cash Flow Estimates Selection of Appraisal Method Risk Return Trade off Market Value Per Share Certainty Uncertainty Payback Period Accounting Rate of Return Net Present Value Internal Rate of Return Profitability Index Capital Rationing Constraint An overview of capital budgeting decision

What is Present Value?

Steps Involved in the NPV Method

1 2 3 4

What is the payback period? The number of years required to recover a project’s cost, or how long does it take to get the business’s money back?

A project has an initial cost of $199,000. The project produces cash inflows of $46,000, $54,000, $57,500, $38,900 and $46,500 over the next five years, respectively. What is the payback period for this project? Should the project be accepted if the required payback period is 3 years?

Year Cash flow Cumulative cash flow 1 $46,000 $ 46, 2 $54,000 $100, 3 $57,500 $157, 4 $38,900 $196, 5 $46,500 $242,

Payback 4

The Discounted Payback

A project has an initial cost of $200,000 and produces cash inflows of $86,000, $93,600, $42,000 and $38,000 over the next four years, respectively. What is the discounted payback period if the discount rate is 10%? Should this project be accepted if the required discounted payback period is 3 years?

Advantages and Disadvantages of the Discounted Payback Period Rule

What is Return on Average Investment (ROI)?

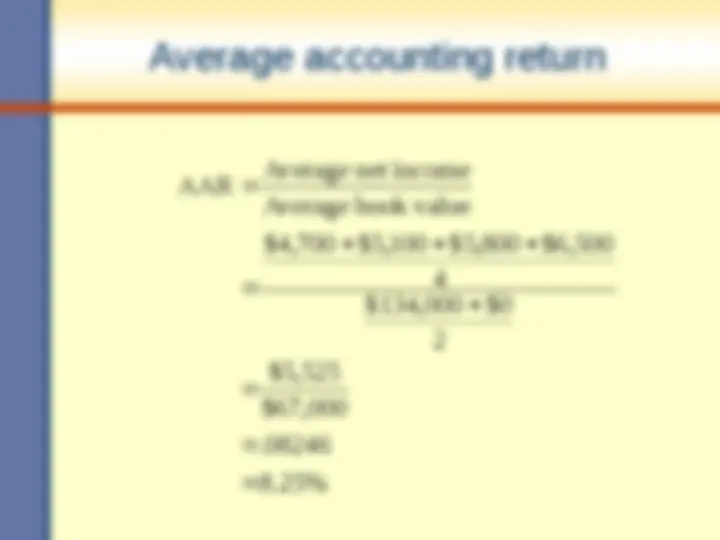

. 08246 $ 67 , 000 $ 5 , 525 2 $ 134 , 000 $ 0 4 $ 4 , 700 $ 5 , 100 $ 5 , 800 $ 6 , 500 Average book value Averagenet income AAR

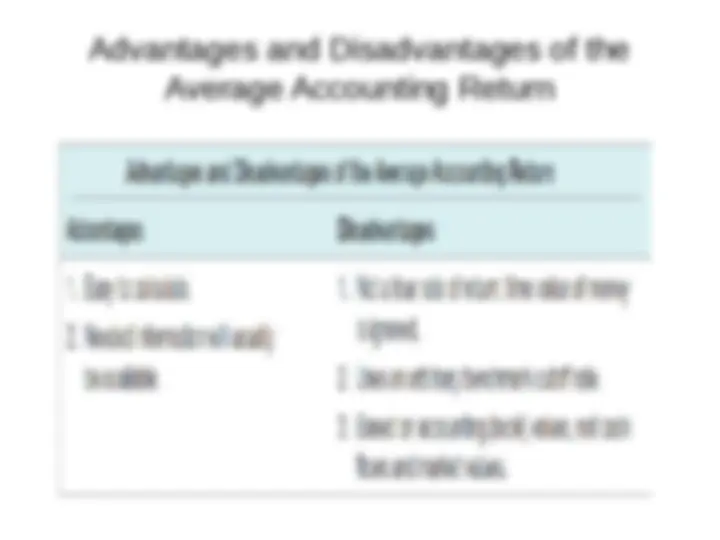

Advantages and Disadvantages of the Average Accounting Return