Download Understanding Money, Interest Rates, and Exchange Rates: A Comprehensive Guide and more Slides Economics in PDF only on Docsity!

Money, Interest

Rates, and the

Exchange Rate

CHAPTER 14

- Anything that can be used for final discharge a debt.

- Credit card is not money

- Balance in checking account is money

- Coins and currency are money

What is money?

- Store of Value

- Save now spend later

- Smoothes inconsistencies between money earned and money spent

- Note: Individuals in high inflation countries my keep other currencies or goods as a store of value.

What can money be used for?

- Coins and paper currency act as primary mediums of exchange – money.

- Demand deposits held at banks and depository institutions provide the same function as currency – money.

What is the Supply of Money?

What is Monetary Base

(B)?

- Cash held by the public (C) and the total quantity of bank reserves (R) on deposit at central bank

B = C + R

- The percentage of deposits (r) banks are legally required to keep on deposit with the central bank

What is Reserve Requirement?

Example

- €80 = Cash in hands of the public

- €230 = Bank Reserve

- Required reserve = 0.

- What is MS?

- MS = 1/0.1 * (310)

- MS = 3100

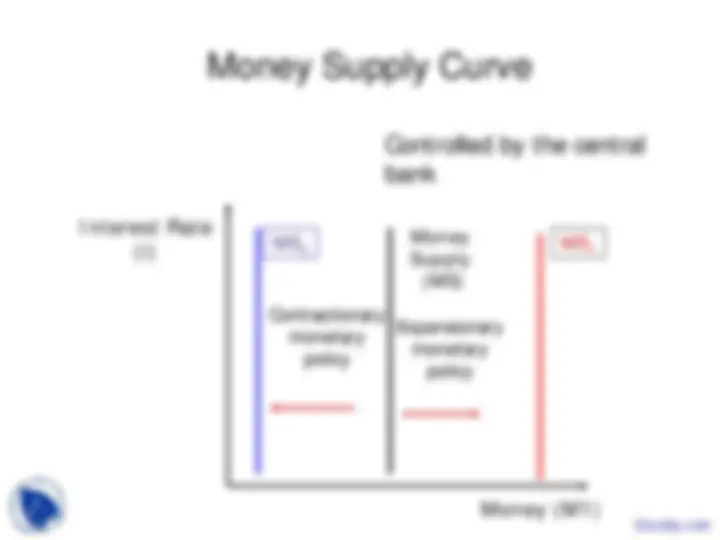

Monetary policy

Refers to central bank changing money supply by changing the monetary base and/or the money multiplier.

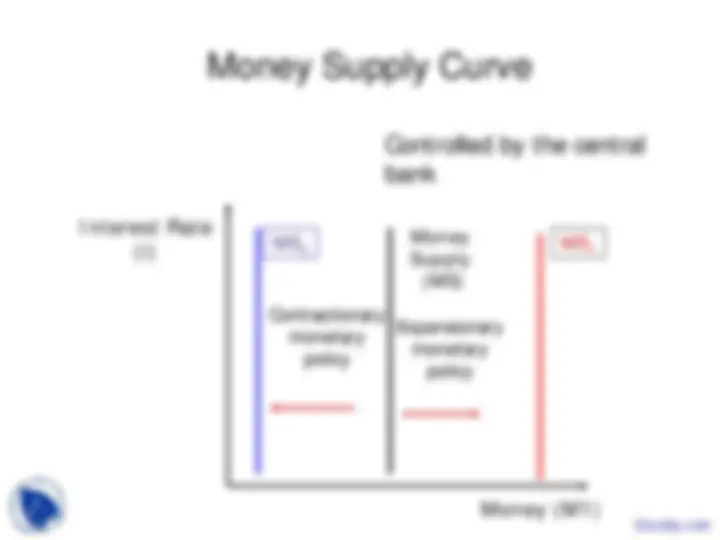

- MS = M1 = 1/r * B MS↑ if B↑ or if r↓

- Changing reserve requirement (r):

- Lower reserve requirement means banks could make more loans.

- Rarely used b/c effect too powerful

How can the central bank

change B or r?

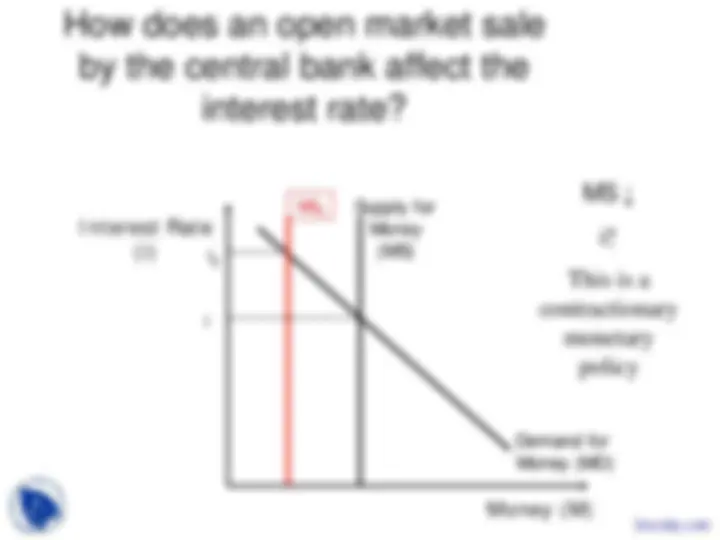

- Open Market Operations, refinancing :

- Buying and selling bonds by central bank

- If the central bank buys bonds, money is given to bond seller (public or bank) and more money is in the economy B↑ MS↑

How can the central bank

change B or r?

I received a question

- Can you please explain again with some examples the open market operations? thank you

Answer

- Bank of Ireland has some government bonds.

- If the central bank wants to increase the supply of money - Offer higher than normal prices for bonds - Bank of Ireland sell their €1000 bond to the central bank - Central bank makes a €1000 deposit into their Bank of Ireland Reserve Account at the central bank. - Bank of Ireland’s reserves goes up Bank of Ireland make more loans that means the people (borrowers) will have more money in their checking accounts (borrowed) M goes up MS goes up

- To buy goods and services.

- Transactions demand for money

- Varies directly with nominal GDP

- In case of emergencies that require purchases above normal spending levels Precautionary demand for money

- As an asset

Why do we demand money

(M1)?

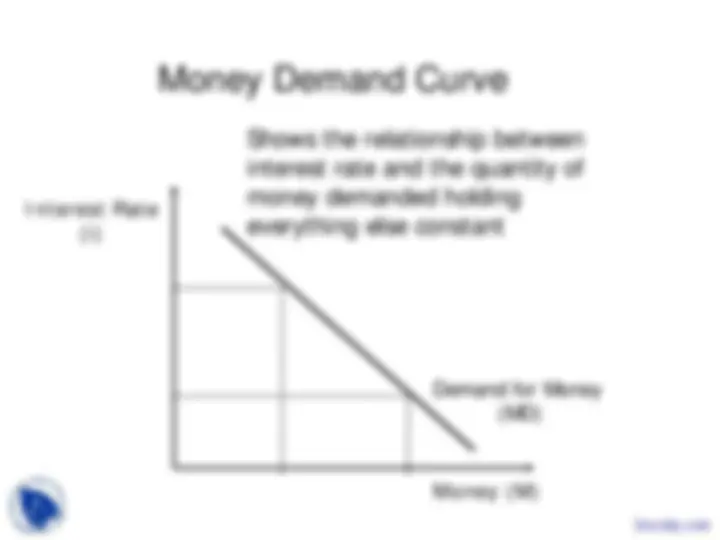

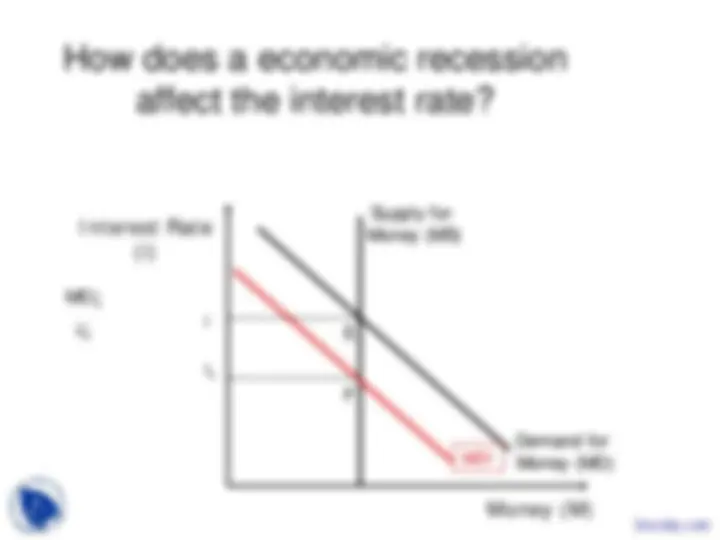

- If interest rates go up, do we demand more or less money?

- Less

- interest rate is the opportunity cost of holding money

- If the price level goes up, do we demand more or less money?

- More

- need more money to cover our purchases

Three motivations for holding money combine to create the aggregate demand for money