Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

hjegfeerghbruthui34yr8o4u3r9tu

Typology: Exercises

1 / 7

This page cannot be seen from the preview

Don't miss anything!

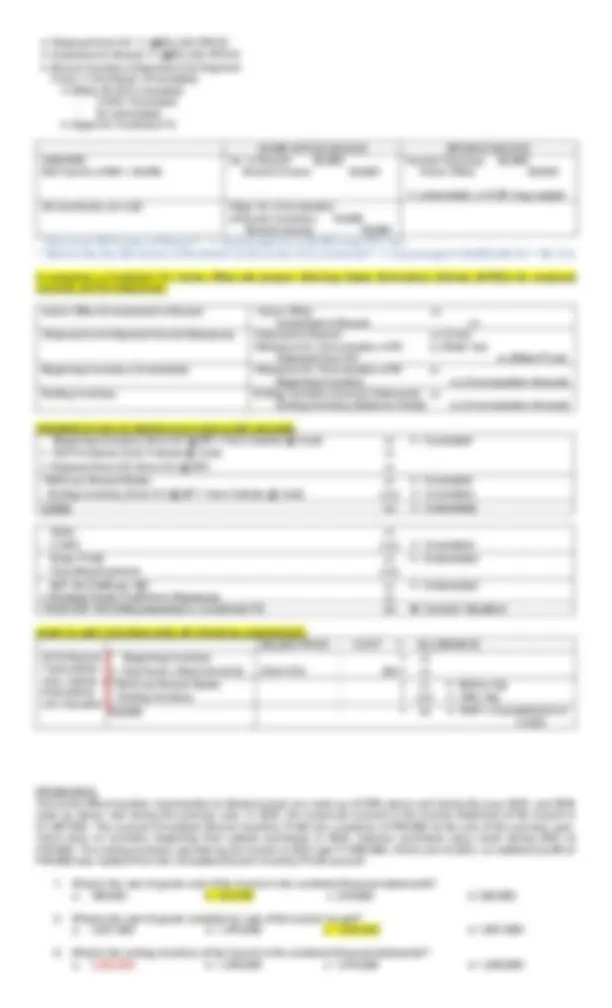

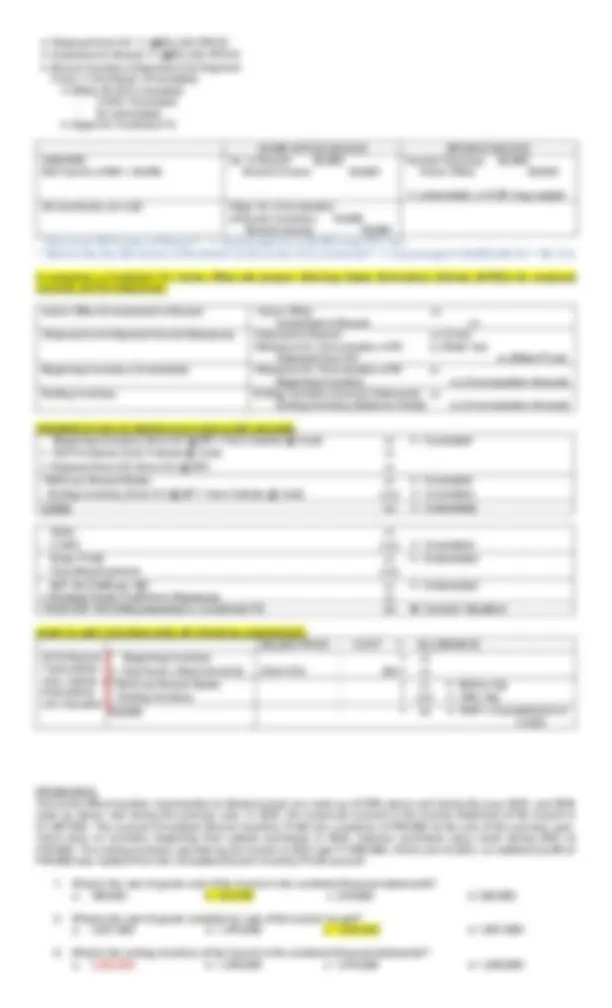

Set up by Home Office as EXTENSIONS Have no Juridical Personality Has autonomy to transact on its own. Has Separate Books; -At the end of the period, Branch has to prepare SEPARATE FS. Branch’s Separate FS cannot be used for External Use because it is incomplete. For it to be use for external use, it must be combined with the Separate FS of the HO. Approves credit application of customers as well as delivers the goods to customers Maintains LARGE stock of Inventory Set up by Home Office as EXTENSIONS Have no Juridical Personality Has no autonomy to transact on its own; what they do is GET ORDERS from customers to be SENT to HO. HO will be the one delivers the goods to customers. Has No Separate Books ; transactions are recorded by the HO. HO can record Agency’s transactions in 2 ways:

Reciprocal Account: Home Office Account Capital Account (Normal Bal = Cr) MUST BE EQUAL ; NOT EQUAL = RECONCILIATION INCOME STATEMENT HOME OFFICE BOOKS Reciprocal Account: Shipment to Branch Nominal Account (Normal Bal = Cr)

Reciprocal Account: Shipment from the Home Office Nominal Account (Normal Bal = Dr) Beginning Balance = Zero ; Must be CLOSED at the end of the period At the end of the period, Home Office shall combine the FS prepared by the Branch and Home Office, wherein:

Shipment to Branch xx Shipment from the Home Office xx Must equal to 0 on the Combined FS after elimination PROBLEM 1: At the end of the year the Investment in Bacolod account of the home office is P300,500. However, there are transactions discovered to have errors. a. Bacolod branch bought equipment on June 1, 2020 costing P63,800 for the home office’s use and the policy is to record the asset in Bacolod’s books. During that time the home office recorded the equipment and credited its reciprocal account of its Bacolod branch If NOT EQUAL, RECONCILE -- The one who failed to record shall be the one to reconcile. -- The one who commit the errors shall be the one to make adjustments.

b. The policy of the company regarding the equipment’s depreciation is that it has a life of 8yrs with no salvage value and the straight-line method should be used. No entry has been made by the home office and branch c. The home office ships merchandise to Bacolod amounting to P96,700. Bacolod recorded the transaction as P97, d. Bacolod pays the home office’s creditors in the amount of P32,400 and sends a debit memo to the home office. Upon receipt of the debit memo, the home office debited its reciprocal account in the amount of P23,400 twice.

1. What is the unadjusted balance of the home office current account in the books of Bacolod at the end of the year? a. 379,600 b. 252,000 c. 286,000 d. 315, 2. What is the net adjustment of the investment in Bacolod account at the end of the year? a. 20,052 debit b. 20,052 credit c. 19,387.5 debit d. 19,387.5 credit 3. What is the net adjustment of the home office current account in the books of Bacolod branch at the end of the year? a. 4,887.5 debit b. 4,887.5 credit c. 5,552 debit d. 5,552 credit SOLUTION: HOME OFFICE BOOKS BRANCH BOOKS Unadjusted Balance 300,500 286, a) Equipment 63, b) Depreciation (4,652) (4,652) c) Shipment (900) d) Debit Memo – BB (79,200) Adjusted Balance 280,448 280, MADE SHOULD BE ADJUSTING ENTRY a) HOB Equipment 63, Invest. 63, Memo Entry only in HOB to signify its use Invest 63, Equipment 63, b) BB No Entry HOB No Entry

Dep’n Exp 4, Acc. Dep. 4, [(63,800 / 8yrs) x 7mos/12mos] Since si HO ang gumamit, BB should allocate the DE to HO account Home Office 4, Dep’n Exp. 4, HOB: (Upon receipt of Memo of the allocation) Dep’n Exp 4, Investment in Branch 4, c) BB Ship. from HO 97, Home Office 97, Ship. from HO 96, Home Office 96, Home Office 900 Ship. from HO 900 d) HOB Inv. in Branch 46, A/P 46,

Inv. in Branch 32,

Inv. in Branch 79, RULES IN ISSUING MEMOS Issued by the HOME OFFICE – Inv in Branch (Dr) Debit Memo: Increase Investment in Branch (Dr) Increase Home Office Account in BB (Cr) Credit Memo: Decrease Investment in Branch (Cr) Decrease Home Office Account in BB (Dr) Issued by the BRANCH – HO Acc (Cr) Debit Memo: Decrease Home Office Account in BB (Dr) Decrease Investment in Branch (Cr) Credit Memo: Increase Home Office Account in BB (Dr) Increase Investment in Branch (Cr) PROBLEM 2: A) Miles Company established a branch in Ayala by sending merchandise costing P924,500 and effecting a fund transfer of P400, cash on January 1, 2020. B) The branch purchased computer equipment costing P420,000 on April 1. As per agreement, the home office will maintain all the property, plant and equipment records. C) Ayala branch collected P56,000 worth of Ortigas branch’s receivable on August 4. Cash remittance to the home was P250,000 on September 28. 1 2 3 = 20,052 = 5,

Shipment from HO @ BILLED PRICE Investment in Branch @ BILLED PRICE Branch Inventory (Shipment to & Shipment From) Not Equal (Overstated) Effect: BI & EI overstated

Total Ending Inventory 1,650,

Depreciation [40,000 * 18% * 1/12] (600) Salaries Exp. (21,600) Rent Exp. [36,000 * 1/12] (3,000) Other Expenses [Expenses under Imprest System] (17,925) Expired Samples [36,000 * 85% / 4mos from Aug 1 – Dec 1] (7,650) NET INCOME OF AGENCY 91,