Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

History of Custom aslkfhaslk fhlk;haldaaslkdjara;lkhal;dhadah;lsd

Typology: Lecture notes

1 / 44

This page cannot be seen from the preview

Don't miss anything!

The Philippines' first tariff law was passed by the

Congress of the United States, tariff act of 1909

approved on August 5, 1909

Some revisions continued to be in force until it was

replaced by the 1937 known Republic Act as the tariff and

custom code of the Philippines on June 22, 1957. A tariff

law was passed by a Filipino congress

It was only in 1957 that tariff emerged as an economic policy

instrument when the objects of Republic Act 1937 were laid

down as

Under this tariff law the rates of duty ranged from

0 to 250% ad valorem.

High rates of duty ranged from 30% ad valorem to

250% were levied on imports which were available

locally in sufficient quantity and comparable quality

such as meat products, coconuts, pianos, etc.

Low rate of duty ranged from 0 to 25% ad valorem

were imposed on raw material and capital goods

required by the manufacturing sector as well as an

essential consumer goods needed, by the masses

such as fertilizer, essential oil, lubricants,

immunizing sera, etc.

HISTORY OF

PHILIPPINE

TARIFF SYSTEM

PHILIPPINE FOREIGN TRADE DURING

PRE- SPANISH PERIOD

China

Japan

India

Burma

Siam (Thailand)

Cambodia

Sumatra

Java

Barter - the customary way of trading with

other people.

Gongs - “metal bells” brought from China

Chao Ju-kua (1209-1214) and Wang Tay-

Uan(1349 - observed that the ancient filipinos

were hones in the commercial dealings.

Philippines, Chinese, Japanese - who brought

silks, woolens, bells, porcelains, perfumes, iron,

tin, colored cotton cloth and other small wares.

DURING THE SPANISH

PERIOD

The ancient almojarifazgo ( a 3% ad valorem duty)

imposed on both imports and exports was amplified to

the philippine customs house was established in

Manila by Governor Guido de Lavezaris in 1573. The

Governor- General did not enforce the almojarifazgo

at once. It took Gonzala Ronquillo de Penalosa the

fourth Spanish Governor- General to impose almoja

rifazgo in 1582.

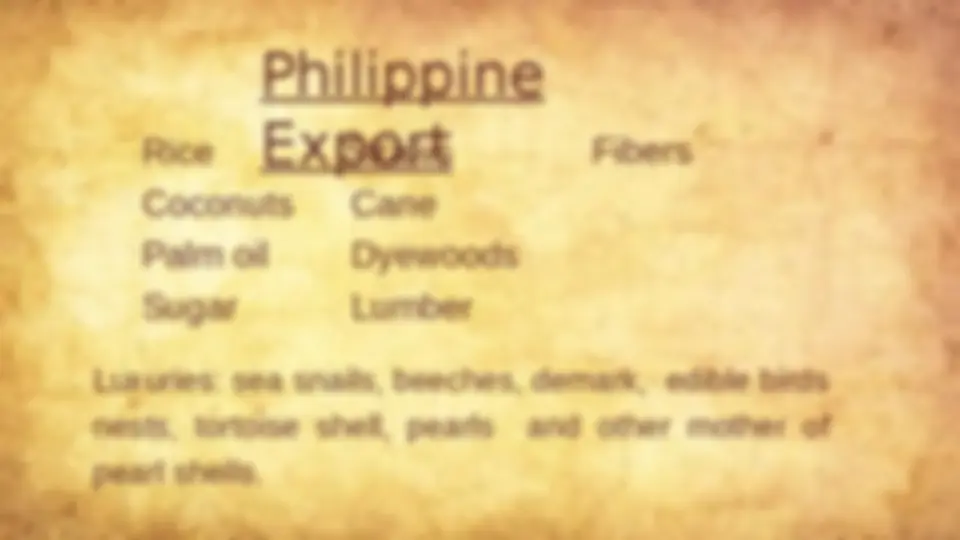

Philippine

Rice Export Fibers

Coconuts

Palm oil

Sugar

Straws

Cane

Dyewoods

Lumber

Luxuries: sea snails, beeches, demark, edible birds

nests, tortoise shell, pearls and other mother of

pearl shells.

Luxury Items sent to Mexico

:

and spices.

government vessels except the those with China, Japan, and

other Oriental countries.

Treasury in 1805.

2.3% on all goods from other countries, except those

from China which was 6%.

3.10% of all Asiatic merchandise to Mexico and based on

official values.

4.3% on all exports other than Asiatic. Duty was based on

official values.

prepare a new tariff bases on the following purposes.

Junta de Arancelus as follows:

1.To increase revenue.

1.To protect the agriculture

and arts of the islands, and

commerce.

Subsequent alterations and amendments were introduced into this

new tariff in 1855, 1857 and 1870 but policy of protection for

Spanish merchandise continued unmodified.

In the year 1857 amendmen, rice, certain books and scientific

instruments were exempted from duty.

In 1870, Suez Canal was opened. Philippine products were

accorded preferential treatment in Spain.

It should be recalled that at the time the United States gained

possession of the Philippines, the Dingley Tariff Law was in

force in the former country.

The Spanish tariff and the modified tariff were enforced from

the occupation of the Philippines in 1898 up to November 15,

1901 were deemed to be only temporary measures pending

the enactment of a general revision of the Philippine Tariff on

September 17, 1901 the Philippine Commission passed Act

no. 230 which initiated a general revision of the tariff.