Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

The concepts of rate of return and risk in the context of foreign investments, using portfolio theory as a framework. It covers calculating the rate of return on foreign investment, the risk of foreign investment, and the benefits of international diversification. It also discusses the correlation of stock indices in different markets and the attraction of foreign investment.

Typology: Study Guides, Projects, Research

1 / 16

This page cannot be seen from the preview

Don't miss anything!

M.Sc. Finance , MSc International Banking and Finance, and M.Sc. International Accounting and Financial Studies

Rate of Return on Foreign Investment The return on foreign investments depends on

Calculating the Rate of Return on Foreign Investment (2) UK US X UK UK UK US X R R R R x R

x x x x

UK 4

UK US X

UK UK

5

( ) ( ) 2 ( , ) ( ( )) ( ( )) 2 ( ( )) ( ( )) ( ) ( ) ( ) ( ) ( ) ( ) ( ) ( ( )) 2 2 2 2 US X US X US US X X US US X X UK US X US X UK US X UK US X UK UK UK VAR R VAR R COV R R E R E R E R E R E R E R E R E R VAR R E R R E R E R R R R E R E R E R VAR R E R E R A standard two asset portfolio equation, but without the weights. 7 Assume that COV(R US , R X ) = 0

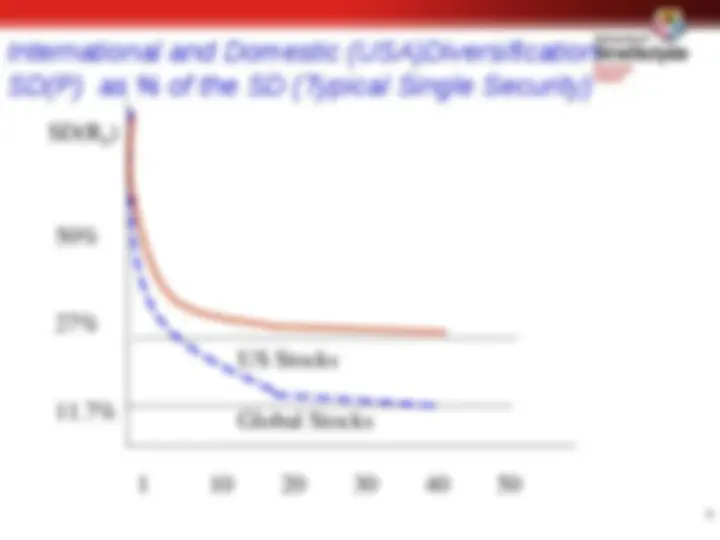

1 10 20 30 40 50 50% 27% 11.7% US Stocks Global Stocks International and Domestic (USA)Diversification SD(P) as % of the SD (Typical Single Security) SD(R P ) 8

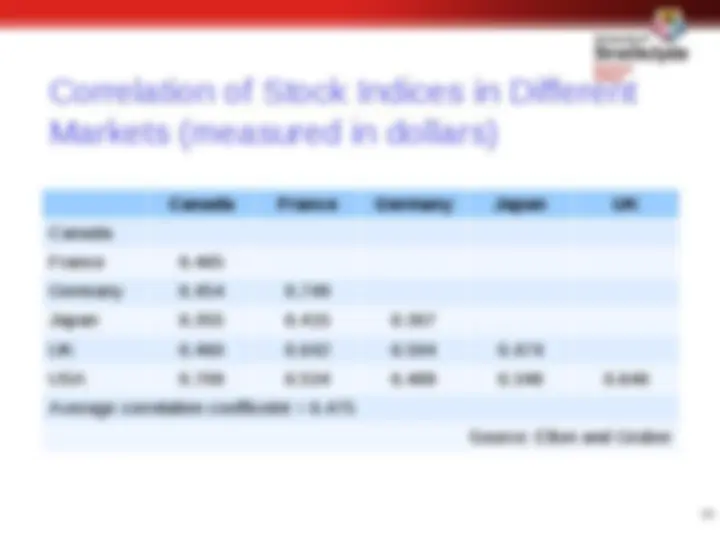

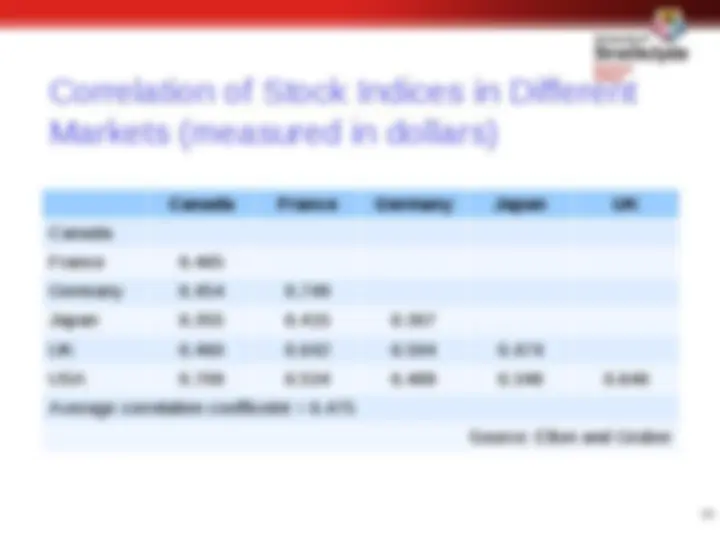

Correlation of Stock Indices in Different Markets (measured in dollars) Canada France Germany Japan UK Canada France 0. Germany 0.454 0. Japan 0.355 0.415 0. UK 0.460 0.642 0.594 0. USA 0.709 0.534 0.489 0.348 0. Average correlation coefficeint = 0. Source: Elton and Gruber 10

When the Ratio of the expected international risk premium (expressed in domestic currency) is higher than for the domestic market international investment becomes particularly attractive. There are further advantages associated with a correlation of less than one between international and domestic returns. 11

I D D D F I I F SD R E R R SD R E R R ,

Analysing the return on a foreign investment

Naïve Diversification on an International Basis Solnik (1974) demonstrated that

Rationale for Home Bias