Download Effect as Tariff - International Economics - Lecture Slides and more Slides Economics in PDF only on Docsity!

Suppose initially quota has the same

effect as tariff

S

D

Price of Cloth

20 30 60 70^ Quantity of Cloth

10

12

S + Q

Tariff

- Tariff = $2 per unit

- Quota = 30

- Gain in producer surplus = a

a

Now domestic demand grows to D’

S

D

Price of Cloth

20 30 60^ Quantity of Cloth

10

12

S + Q

D’

Under tariff, P is still 12, imports go down to to 10 and the gain in producer surplus remains the same ( a= b + c)

Under quota, at p =12 there is a surplus P↓ to 11, domestic production goes down to 25 and producer surplus goes down to c

40

b

Quota is more restrictive

11

25 55

c

- Fair trade is an organized social

movement that promotes the payment of a fair price as well as social and environmental standards in areas related to the production of a variety of goods.

- The movement focuses on exports

from developing countries to developed countries, most notably handicrafts, coffee, cocoa, tea, bananas, honey, cotton, wine, fresh fruit etc.

- Fair trade's strategic intent is to deliberately work with marginalized producers and workers in order to help them move from a position of vulnerability to security and economic self- sufficiency.

- It also aims at empowering them to become stakeholders in their own organizations and actively play a wider role in the global arena to achieve greater equity in international trade.

- Fair trade proponents include international religious, development aid, social and environmental organizations such as Oxfam, Amnesty International, and Caritas International.

- The next slide shows a photo of a Oxfam store in Galway

Controversy

- Some economists see fair trade as a type

of subsidy that distorts free trade.

- Segments of the left criticize fair trade for

not doing enough.

Chapter 8

- Suppose there is a proposal to impose a new tariff on imported widgets

- There are 10,000 consumers of widgets in the US

- Demand for widgets is perfectly inelastic

- Each American buys a widget no matter what the price

- If the tariff becomes effective, the price of widgets goes up by $

- That is each consumer loses $

- All consumers together lose $10,

- If the tariff becomes effective each of the 3 domestic producers of widget gain $1000.

Case 2: Representative

Democracy

- In order to make your representative aware of your wish you need to hire a lobbyist who charges $

- Who is more likely to hire the lobbyist?

- None of the consumers

- since they each will only lose $1 if the proposed tariff become law.

- and it takes time and effort to get organized.

- But each of the producers has an incentive to hire the lobbyist since he will gain $1000 if the tariff goes into effect.

So under Representative

Democracy

- Tariff is likely to be imposed

- This is called rent –seeking behavior

- Occurs when government approves a program that benefits only a small group within society, but the society as a whole pays the cost.

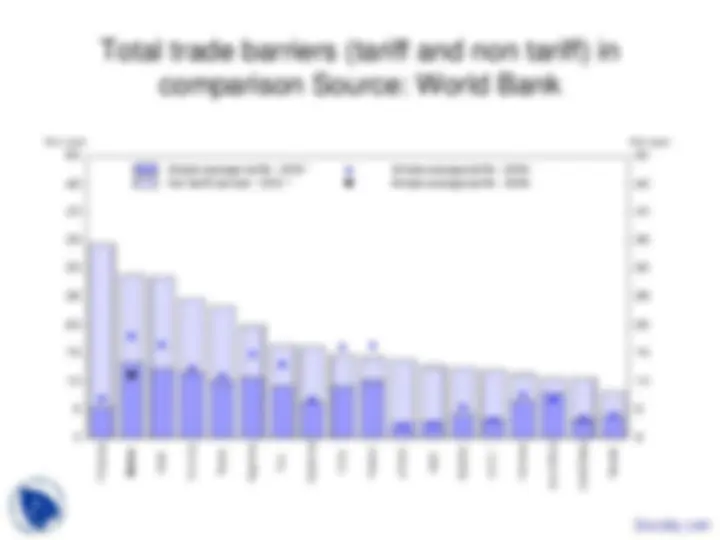

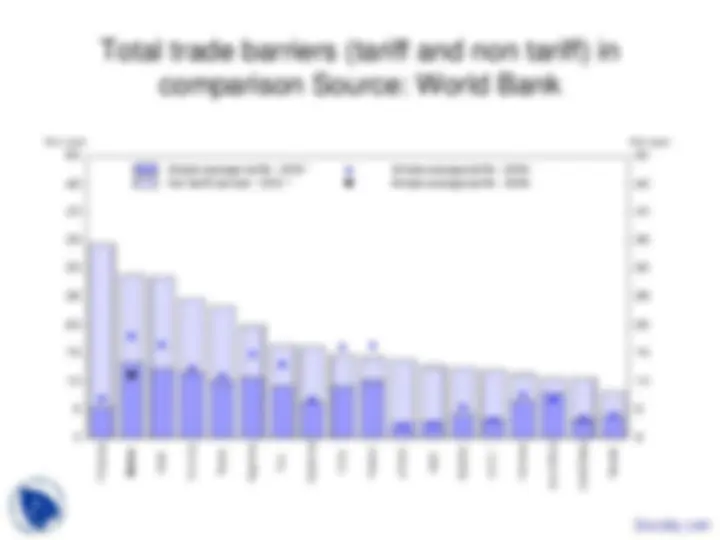

Total trade barriers (tariff and non tariff) in

comparison Source: World Bank

- Facts:

- Imports and exports have conflicting effects.

- Free trade benefits consumers but firms and workers in importing industry can be harmed.

- Regulation can favor one segment of society.

- Domestic industries and firms have a demand for government regulation. 5. Special interest groups lobby for changes that benefit them.

The Political

Economy of Protectionism

Answer

- Not necessarily;

- The loss in one consumer’s surplus due to trade restriction may not even be noticeable to him.

- Consumers cannot easily form groups, get organized and let politicians hear them but firms can.

- Given group support, votes to politician may increase.

- Politicians favor programs having immediate and clear-cut benefits with vague or deferred costs.

- Detailed tariff schedule allows politician to pick up votes for protecting specific good without protests from average consumer. - Tariffs on very similar goods may be very different.

- Firms with comparative advantage

lobby foreign governments for free

trade of exports.

- Firms that compete with imports

would lobby for protection from

imports.

Who does what?

1. Cost-based dumping

- A firm sells a product at a price below its cost of production in a foreign market.

2. Price-based

- A firm sells a product in a foreign market at a price lower than the price charged in its home market.

What is dumping?

1. Sporadic dumping

2. Persistent dumping

- Because there is more competition in the foreign market than at home.

3. Predatory dumping

- Temporary

- To drive competing firms out of business.

Types of Dumping