Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

business law reconsideration, Study Guides, Projects, Research of Law

notes and lectures used in discussions

Typology: Study Guides, Projects, Research

1 / 1

This page cannot be seen from the preview

Don't miss anything!

Related documents

Partial preview of the text

Download business law reconsideration and more Study Guides, Projects, Research Law in PDF only on Docsity!

ATENEO DE NAGA UNIVERSITY

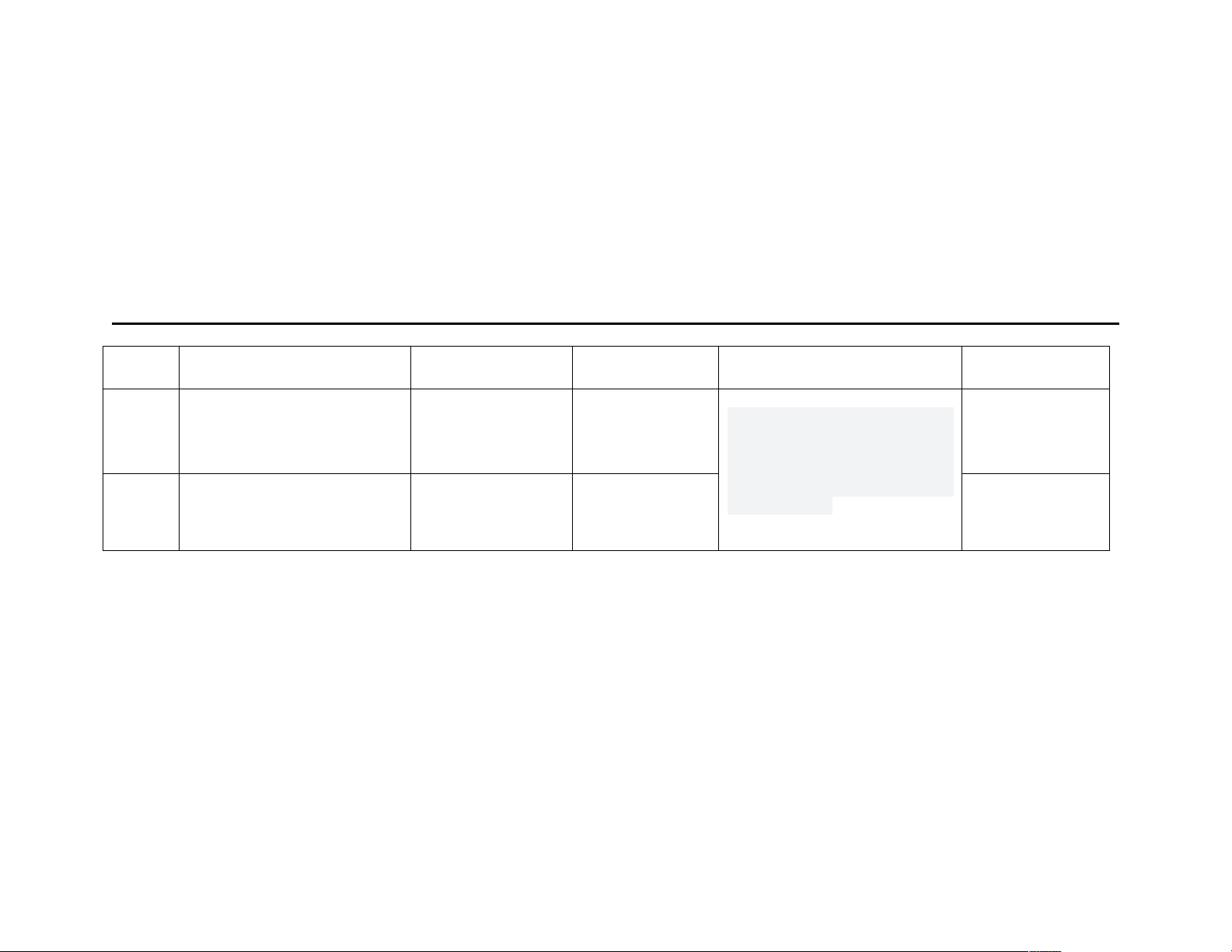

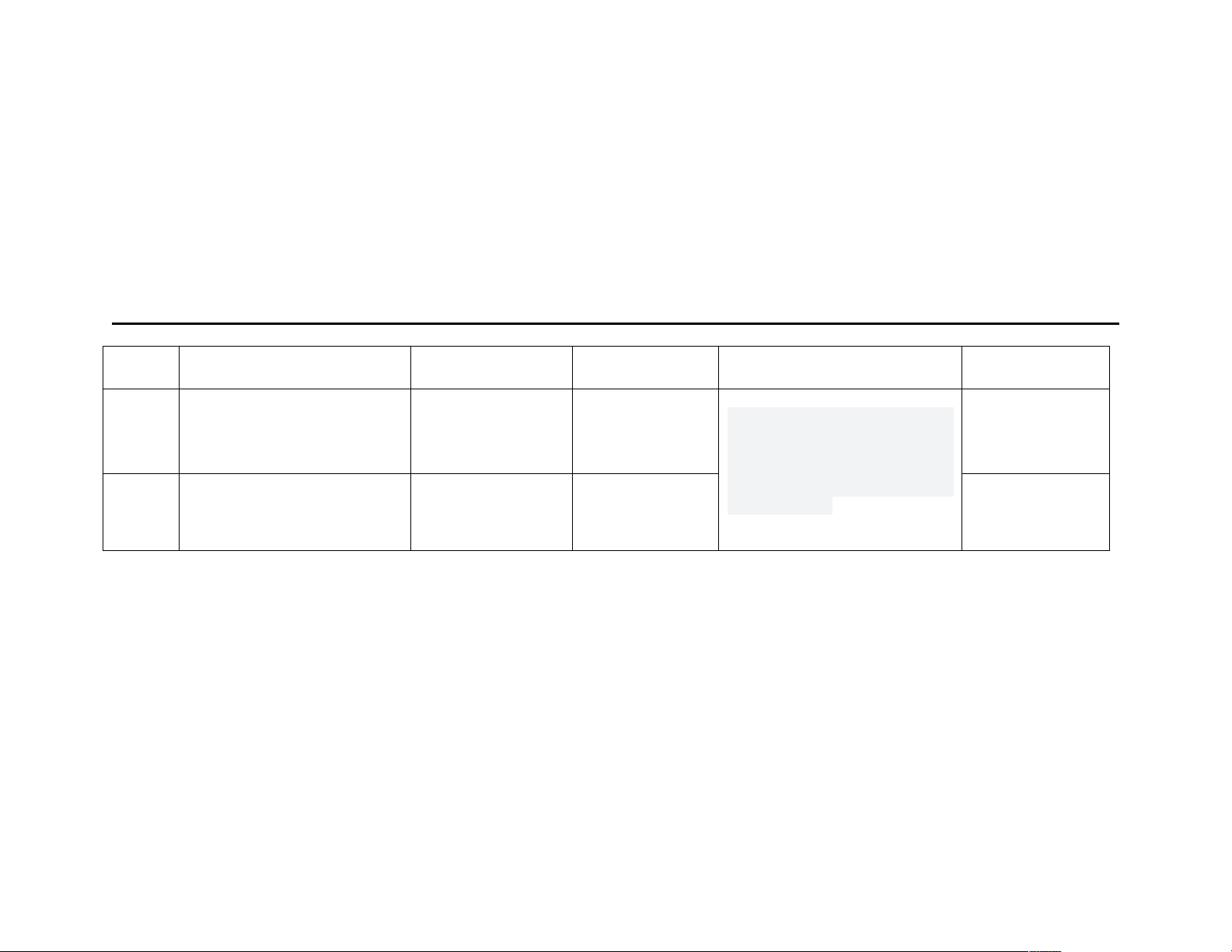

College of Business and Accountancy Department of Accountancy Integrated Accounting (ACCM456) Type: Quiz 2 Subject: Practical Accounting 1 (P1) To: Dr. Christopher Abelinde, CPA Re: Reconsideration of items/answers in Quiz 3 Date Submitted: October 18, 2019 ITEM NO.

PROBLEM SUGGESTED

ANSWER

ALTERNATIVE

ANSWER

JUSTIFICATION REMARKS

9 In its 2011 income statement, what amount should ABC report as depreciation for this machinery? A. 10,500 May also consider Bonus The^ topic^ depreciation^ is^ not included in the coverage of the quiz. The coverage of quiz 2 is only Inventories, PPE acquisition, Building and Land, and Machinery. 10 The accumulated depreciation balance at December 31, 2012, should be A. 102,000 May also consider Bonus NOTHING FOLLOW