Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

This study note provides you enough sample problems and/or situation about adjustments or adjusting entries which can help you fully understand accrual, deferrals, depreciation, and allowance for doubtful accounts.

Typology: Study notes

1 / 73

This page cannot be seen from the preview

Don't miss anything!

Identifying and Analyzing Business Transactions Recording in the Journals Posting to the Ledger Unadjusted Trial Balance Adjusting Journal Entries Adjusted Trial Balance Financial Statements (FS) Closing Entries Post-Closing Trial Balance Reversing Entries The Accounting Cycle

Purpose of AJE This is prepared to confirm with the accrual concept and matching principle. Accrual Concept states that income is recognized when earned regardless of when it was collected and expenses are recognized when incurred regardless of when it was paid. Matching Principle matching principle aims to align expenses with revenues. Expenses should be recognized in the period when the revenues earned with them are recognized.

Why is AJE Important? ▪ At the end of the accounting period, some income and expenses may have not been recorded, taken up or updated; hence, there is a need to update the accounts. ▪ If adjusting entries are not prepared, some income, expense, asset, and liability accounts may not reflect their true values when reported in the financial statements.

Accruals Accrual adjusting entries are the means for including transactions that occurred during the current accounting period but have not yet been recorded in a company's general ledger accounts. Without accrual adjusting entries, those transactions will likely be reported in a later accounting period.

Accruals Accrual Accrued Income Accrued Expense

Accrued Income

Receivable account X,XXX Income account X,XXX

Accrued Income Example 1 : The company leases its building space to a tenant. The tenant pays monthly rental fees of P 2 , 000. On June 30 , no entry was made. AJE would be: June 30 Accrued Rent Income P 2 , 000 Rent Income P 2 , 000 OR June 30 Rent Receivable P 2 , 000 Rent Income P 2 , 000

Accrued Income Example 3 : The company lent P 9 , 000 at 10 % interest on Dec 1 , 2021. The amount will be collected after 1 year. No entry was made on the interest earned at the end of the year. AJE would be: Dec 31 Interest Receivable P 75 Interest Income P 75

Accruals Accrual Accrued Income Accrued Expense

Accrued Expense

Expense account X,XXX Liability account X,XXX

Accrued Expense Example 4 : The employees worked for the last three days of the year 2021. The total wage for the employees is P 5 , 000. The transaction was not recorded in the accounting books. To record the AJE: Dec 31 Salaries Expense P 5 , 000 Accrued Salaries Expense P 5 , 000 OR Dec 31 Salaries Expense P 5 , 000 Salaries Payable P 5 , 000

Types of Adjusting Journal Entries Accruals Deferrals Depreciation Allowance for Bad Debts Adjusting Journal Entries

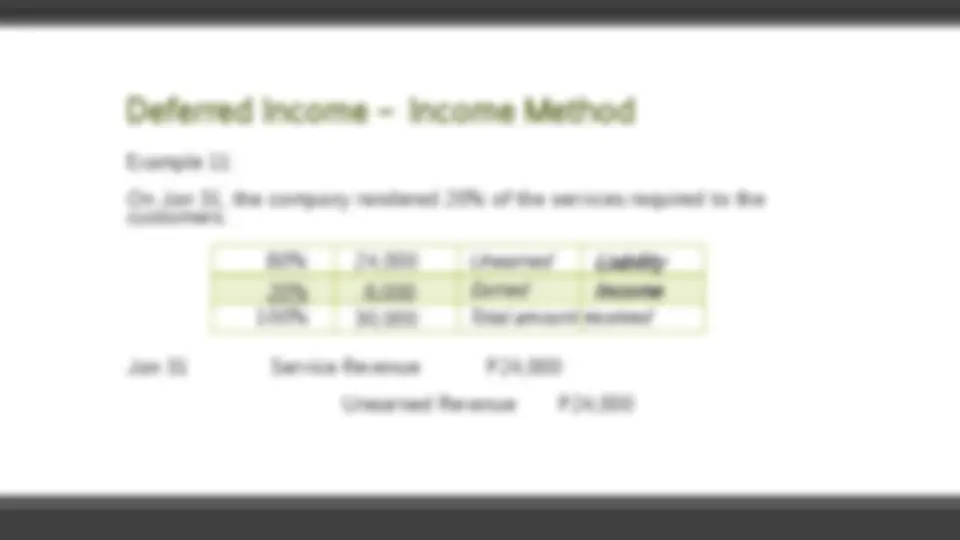

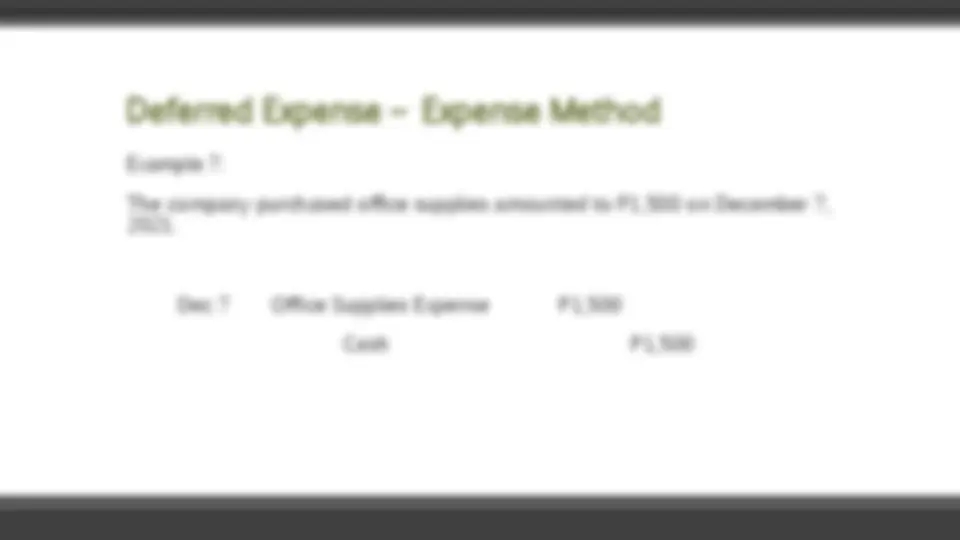

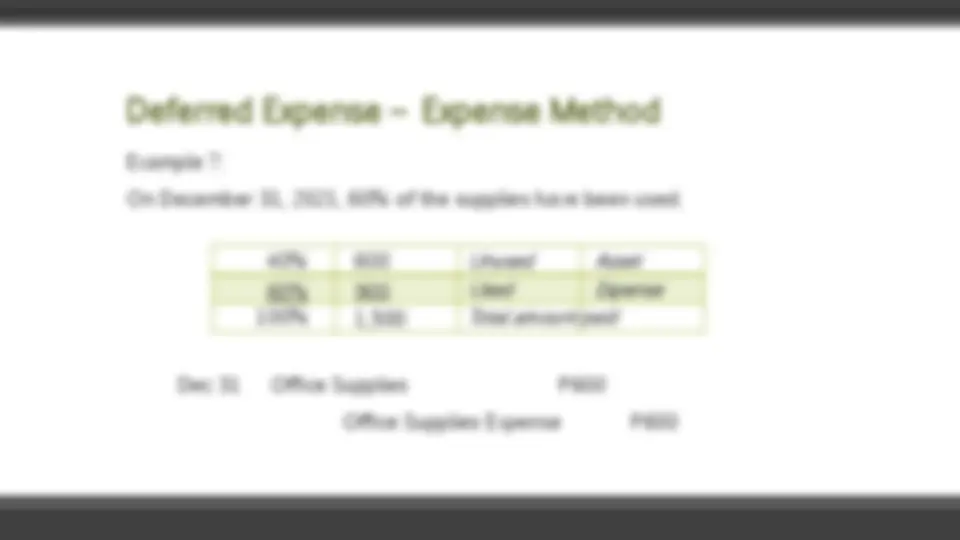

Deferral

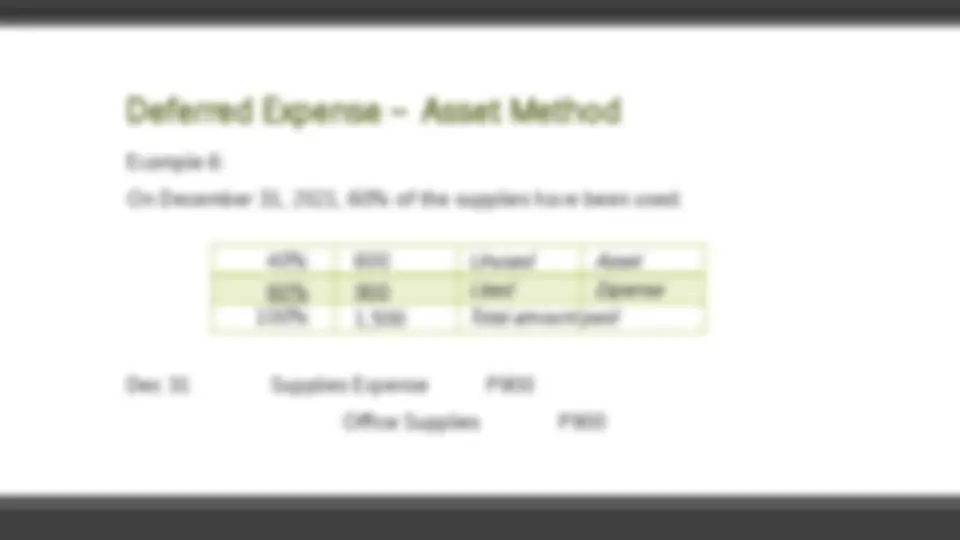

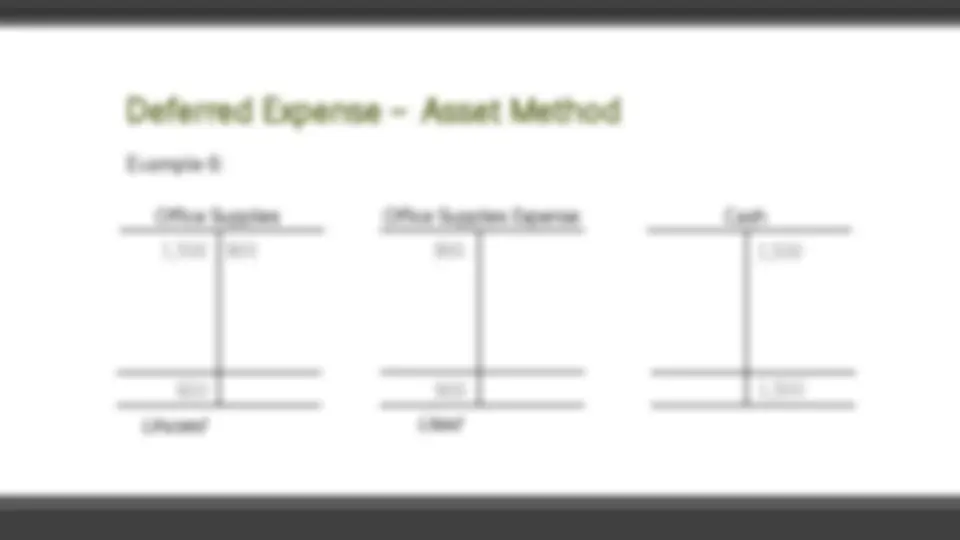

but not yet incurred” or of “revenue already collected but not yet earned.” A journal entry that adjusts an amount already recorded on the books of a company because part of the amount pertains to a future accounting period.